What Is FICA On My Paycheck? What Is FICA Tax

What is FICA on my paycheck? – FICA tax is basically the tax that is withheld from your paycheck for Medicare and Social Security. The Social Security and Medicaid & Medicare Planning help in providing benefits for children, disabled, and retirees. It is a US federal tax for payroll and is deducted from both employees and employers. The money is automatically deducted from your paycheck.

In this article, you will learn some general details about the FICA tax and what are its constituents. Next up, we will also discuss this tax works and the way in which it is calculated. Then we will give you reasons why paying the FICA tax is important. Finally, we shall explain the ways in which the FICA tax is different from the Federal Income Tax. Hence, to learn more, read on through to the end of the article.

What Is The FICA Tax?

According to Investopedia.com,

“The Federal Insurance Contributions Act (FICA) is a U.S. law enacted in 1935 that mandates a payroll tax on the paychecks of employees, with matching contributions from employers. The money collected is used to fund the Social Security and Medicare programs.”

Since the enactment of the act, the main idea was that every working person would add a certain amount from their paycheck to the government throughout their working life. Both employees and employers would contribute a matching percentage.

The collected money is used to fund social security programs and Medicare programs. The people who contributed will be able to count on their earned health and financial benefits later on in their life. The FICA contributions include your current benefits as well as future benefits when you get old.

On the other hand, it is also important for you to know that you cannot opt out of paying FICA taxes, especially if you are a wage earner. The FICA taxes are also used to fund Social Security Programs that offer benefits to retirees, children, disabled, and surviving spouses.

How Does The FICA Tax Work? – 2023 Rates

The FICA tax was started during the Great Depression and is used to fund essential parts of the safety net of the government. These nets are called Social Security and Medicare. The FICA tax was started in 1937 as a part of Franklin D. Roosevelt’s New Deal.

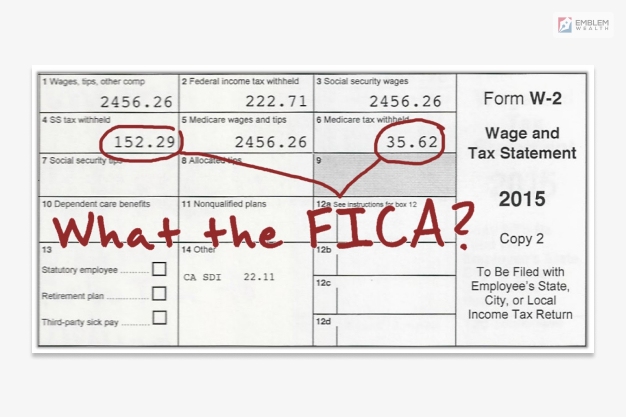

FICA taxes amount to 15.3% of your gross pay, which includes both the Social Security tax as well as Medicare taxes. However, you will only need to pay half of the total 15.3%, that is, you will need to contribute 7.65%. Out of this 7.65% of your contribution, the Social Security tax is 6.2%, and the Medicare tax is 1.45% only.

You must understand here that your FICA taxes are payroll taxes. That is, your employer will withhold 7.65% from your paycheck by the end of the month. Hence, you will see the deductions on your paycheck. In some cases, the social security taxes are known as OSADI (old-age, survivors, and disability insurance) taxes. On the other hand, the hospital insurance tax is called the Medicare tax.

According to the information by Nerdwallet.com,

“In 2023, only the first $160,200 of your earnings are subject to the Social Security tax, up from $147,000 in 2022. There is an additional 0.9% surtax on top of the standard 1.45% Medicare tax for those who earn over $200,000 (single filers) or $250,000 (joint filers). Your employer is also responsible for paying half of the total FICA obligation.”

Here, it is important for you to know that if you are a self-employed person, you will still need to pay FICA taxes. You will be responsible for directly paying the FICA taxes since you do not have an employer to do so.

Why Do You Need To Pay The FICA Tax?

According to the United States Social Security Administration (SSA),

“Think about FICA like this…The money you pay in taxes is not held in a personal account for you to use when you get benefits. Today’s workers help pay for current retirees’ and other beneficiaries’ benefits. Any unused money goes to the Social Security trust funds to help secure today and tomorrow for you and your family.”

If you have an earned income, whether your wages from an employer, or your self-employed income, then you have to pay FICA taxes. Once you receive a paycheck from your employer, the FICA taxes are automatically deducted. Here you and your employer are splitting the tax burden fifty-fifty. However, there are some exemptions for some people, as they are not eligible for the FICA taxes.

There are some people who are called “exempt workers.” This means that these workers do not want their employers to withhold federal income tax from their paychecks. However, they will still need to pay for their Social Security and Medicare taxes as FICA taxes to the government.

How Does The FICA Tax Differs From Federal Income Tax?

According to the Wall Street Journal,

“Federal income taxes fund programs, goods, and services for the public benefit like national parks, highways, and more. Income taxes also pay interest on debt held by the U.S. government.”

The federal income tax is different from the FICA taxes. However, both of these taxes are deductions from your wages and are used to fund different government activities. The FICA tax is used to fund the Social Security Trust funds and the Medicare Hospital Insurance Trust Fund, and it also pays for the benefits associated with those government programs.

Summing Up

As you contribute to your FICA taxes, you are paying your current benefits and are also building your future benefits from the same taxes, which shall be owed to you later. If you are a wage earner, FICA taxes are withheld from your gross pay, and the percentage deducted depends on your gross pay.

Hope we have answered your question, “What is FICA on my paycheck?” – As a wage earner, it is compulsory for you to pay FICA taxes. Do you have any recommendations regarding how the government collects such social security taxes? Share your ideas with us in the comments section below.

Continue Reading:

Leave A Reply