5 Best Micro Investing Apps In 2021 – Latest Updates

In case you only can afford a small amount of money for investing, micro investing is the perfect option for you. It is also known as spare change investing. This is the reason why micro investing apps are cracking down the barriers to normal traditional investing.

In order to start investing with micro investing, you will not need large chunks of money, as you can buy fractional shares of ETFs and shares. And being a beginner, you will be able to learn about investment without putting a lot of money at risk.

5 Best Micro Investing Apps In 2021 – Latest Updates

It is really great that you have made your decision for micro investing, but as there are a huge number of micro investing apps in the market, it is really hard to choose which one is right. So, here I am with the 5 best micro investing apps in 2021.

1. Acorns

In the year 2012, Acorns was launched as the very first micro investing apps. Apart from this, it is also a robo-advisor, which makes it a proper fit for hands-off investors.

Apart from investing your money in ETFs Micro shares, for you, they also automate most of the investment process. On the basis of your financial goals, it also recommends the ideal portfolio.

It comes with a feature named Round-up, which automatically takes money from your designated bank account in order to make the investment.

Advantages

- Offers value-based investing options.

- Very easy to use.

- Specific retailers offer cashback.

Drawbacks

- For larger accounts, you need to pay high fees.

- Investment options are limited.

- You will be able to invest too little.

Fees

- Acorns Core charges $1 on a monthly basis for a personal taxable account.

- Acorns Core + Acorns Later charges $2 per month and also allows you to invest also in IRA. This is a retirement fund with tax advantages.

- Acorns Spend + Acorn Later + Acorns Core charges $3 monthly. This comes with a checking account, which has zero account fees along with reimbursed ATM fees.

2. Robinhood

With the intention of “democratize finance for all,” in the year 2013, the Robinhood app was launched in the market. In order to do that, this app trades ETF, stocks, and options with simply no commissions or any kind of trading fees.

You do not need to pay any monthly management fees and no signing up fees as well. The pricing structure of Robinhood was so radical that it forced many other online brokerages to eliminate commission.

The list of those brokerages includes Fidelity and Charles Schwab. Till the time you are becoming capable of buying full shares, this is one of the best MCRI investment apps, especially for free trades.

Advantages

- No signup fees.

- Easy to use, simple app.

- No account management fees with zero commissions.

Drawbacks

- Has expired outages.

- Account options are limited.

3. Stash

If you are a beginner and also want to learn the ins and outs of investing, you should get your hands on Stash. For three different account levels, it has flat monthly fees. The best thing is that there are no commissions and additional trading fees.

Once you are done with the whole sign-up process, you will be asked a series of questions about your financial goals and current financial situation in order to evaluate the investment risk level yours.

Advantages

- Flexible investment options.

- In-app educational content.

- Investment options are value-based.

Drawbacks

- ETF expense ratios are high.

- On some accounts, the fees are high.

Fees

- Beginner plan at $1 monthly comes with unlimited trades, a personal investment option from Avibra’s $1,000 life insurance policy, and Stock-back cards.

- The Growth plan at $3 per month offers everything from beginner plans along with personalized retirement advice, retirement accounts, Smart Portfolio.

- The Stash+ plan comes at $9 on a monthly basis includes everything of the Growth plan along with 2 times stocks with the Stock-back card, up to 2 children’s custodial account, and through Avibra, a life insurance policy of $10,000.

4. Betterment

Betterment is famous with the name of OG Robo-advisor. It means that Betterment is one of the very first investment apps, which took the leverage of technology in order to simplify the whole investment process.

In case you need more support, it is hands-off along with giving you the real financial dollars. At the time, when you will sign up in this app, it will assist you in identifying your financial goal. Apart from that, it will also recommend portfolios for your every goal.

Advantages

- On all accounts, tax coordination.

- Investing is goal-based.

- Low management fees along with no minimum investment.

Drawbacks

- Financial advice is a bit pricey.

- For hands-on investors, do not offer any option.

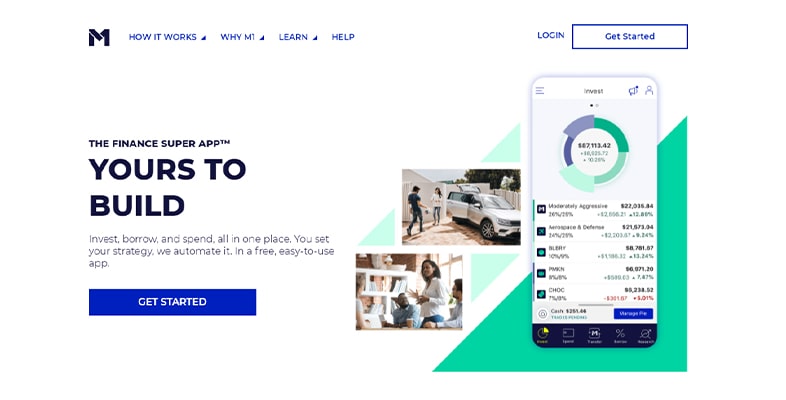

5. M1 Finance

You can consider M1 Finance as a hybrid micro-investing app. It is a combination of Acorns and Betterment’s Robo-advisory service along with Stash and Acorns’ hands-on control. So, clearly it is one of the apps that can offer the micro investors a bit of everything.

Apart from this very unique approach, this app also does not charge any monthly management fee, trading fee, or commissions. When you combine the hybrid approach, and the low cost, this app, M1 Finance, is millennial-friendly.

Advantages

- No minimum initial deposit.

- Flexible portfolio building that offers you expert advice when allowing for customization.

- No asset management fees or trading fees.

Drawbacks

- Charges an inactivity fee after 90 days of trades.

- Asset types are limited. You only can buy micro-shares and full shares of ETFs and stocks.

- In order to offset capital gains that are made when assets are sold, many automated services offer tax-loss harvesting, but not in this case.

Fees

- The basic account is totally free.

- M1 Finance Plus plan is also available for $125 per year, offers cashback rewards, lower borrow rates, more ATM reimbursement, a high-interest rates checking account, and many more.

Bottom Line

So, these are the 5 best micro investing apps in 2021 that you can consider if you are thinking of micro investing. Make sure you are choosing the one, which will be able to fulfill all your requirements and also fit in your budget.

Read Also:

Leave A Reply