Facts & Tips To Filing Business Taxes For LLC For The First Time

If your business is a Limited Liability Company (LLC), you will get more flexibility to choose how the IRS should tax the earnings of your business. Eventually, you will have more options if you are filing business taxes for an LLC for the first time. Basically, there are no specific tax rules for LLCs. Hence, there is the option to choose. The one you choose will heavily influence what type of tax filing rules you are subject to.

In this article, you will learn how the IRS taxes LLCs and how the system works for such businesses. Next up, we will offer you some essential tips to file business taxes for your LLC, which will be of great help to you if you are filing for the first time. Here, you will get tips on how to file as a single-member LLC, a multi-member LLC, a corporation, a C Corporation, and an S Corporation. Hence, read on to learn more.

What Are Taxes For LLCs?

According to Intuit Turbotax,

“The IRS mostly ignores LLCs for tax purposes and considers two or more people or businesses working together in a trade or business to be a partnership for tax purposes. However, if you are the sole owner of an LLC, then the IRS “disregards” your LLC and considers you a sole proprietor. LLCs can be formed under state law and then elect how to be treated for federal taxes.”

You can get a lot of flexibility if you are the owner of an LLC. Hence, you will get enough options on how you want to be taxed by the IRS. You can choose between sole proprietorship, general partnership, or corporation. If you want to go into the details, you will need to take a good look at the US tax code.

Being an LLC comes with its own benefits and some drawbacks as well. Most business owners start their businesses as a sole proprietorship. However, as time passes and as the business grows, most businesses become limited liability companies because they want liability protection for themselves. This is because an LLC offers businesses with limited personal liability. This allows business owners to not worry about their tax liabilities. Furthermore, business owners also change the way they pay their income taxes.

Tips For Filing Business Taxes For LLC For The First Time (Default)

Here are some of the major tips for you that will help you file business taxes for your LLC if you are doing so for the first time:

1. Filing As A Single-Member LLC

A single-member LLC is one that has a single owner. By default, these owners are taxed just like sole proprietorships. However, the owner also gets the chance to choose to get taxed like S corporations and C corporations.

According to Shopify.com,

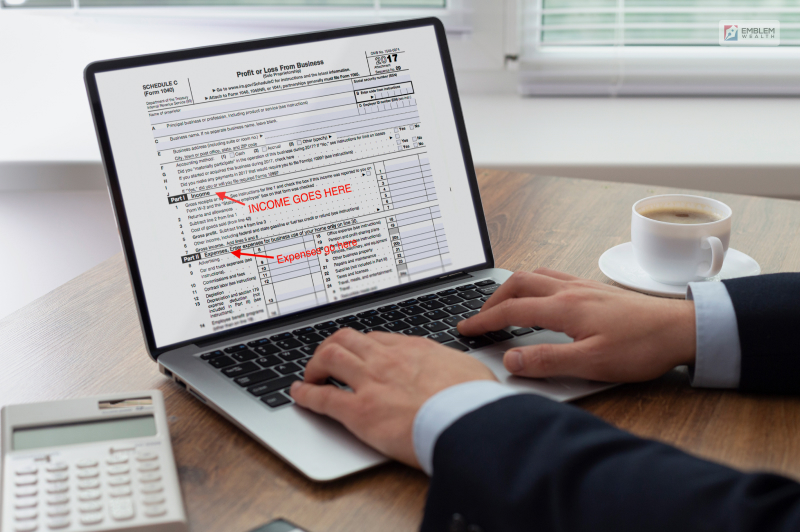

“In the context of this default status, all income flows directly to the single member, as it does in a sole proprietorship. The member reports any income and expenses on Schedule C of their personal income tax return, and net profit or loss on the income section of the US Internal Revenue Service’s Form 1040, Individual Income Tax Return.”

To file taxes as a single-member LLC, you will need to use Schedule C when you do income tax returns for your personal income. Here, you have to report your income and expenses based on your business. You can use that amount as gain/loss in Form 1040.

2. Filing As A Multi-Member LLC

According to FreshBooks.com,

“If more than one person owns the LLC, the default tax status is to treat it as a partnership. Filing gets a little more complicated with a multi-member LLC versus when there’s only one LLC member. The LLC will need to fill out a partnership information return, Form 1065.”

The LLC will also have to provide each of its members with Schedule K-1. Each of these must contain details like the income share of each partner, credits, deductions, and more. Based on the information in Schedule K-1, the IRS Form 1040 and Schedule E must be filled.

You will need to submit the Schedule K-1 by 15th March. By the next month (15th April), you will report that information on Form 1040 and Schedule E.

Tips For Filing Business Taxes For LLC For The First Time (Corporation)

As already discussed, you will get a lot of flexibility with your tax status if you become an LLC. Based on the structure of your LLC, you can stick to the default options (as in the points explained above). However, you can choose to become a Corporation (C or S).

Note that changing your business tax option will not change your business structure. It will still be operated as an LLC. You are just choosing how the IRS should treat your tax liabilities. Here are the two options from which you can choose yours:

1. Filing As A “C” Corporation

If you want to file your federal income taxes as a C Corporation, here is what you must do:

- Complete and submit the IRS Form 8832. This will enable you to select which type of tax option you want.

- To file for your business taxes, you will need to file Form 1120 annually.

2. Filing As An “S” Corporation

If you want to file your federal income taxes as a S Corporation, here is what you must do:

- Complete and submit the IRS Form 2553. This will enable you to select which type of tax option you want.

- To file for your business taxes, you will need to file Form 1120-S annually.

Since S Corporation is a pass-through entity, you will have to pay its taxes through your personal tax returns. Hence, you will need to fill out more forms:

- Each owner will receive Schedule K-1. Report information on Part II of this schedule.

- File that Schedule along with Form 1040.

Final Thoughts

Hope this article was helpful for you in filing business taxes for an LLC for the first time. If all these sound confusing to you, you must consider finding a tax professional who can guide you to file taxes. However, you might have understood that the IRS offers flexible tax filing options for owners of LLCs. This means that you can choose how you want to get taxed.

Make sure that you are using top accounting software for your business while you are filing taxes. Otherwise, going to a tax professional should be your first priority. If you have more tips to add regarding how to file taxes for LLCs, consider sharing them with us in the comments section below.

Continue Reading:

Leave A Reply