Compound Annual Growth Rate: All You Need To Know

Do you want to know about the Compound Annual Growth Rate? If yes, you must read this article till the end to get a complete insight about it. CAGR measures the investments’ average annual growth over a certain amount of a given period or time.

You will get the details of the average annual rate of return from your investments over a particular year. It is one of the effective tools for investors as CAGR reflects the investment growth or decline over time.

At the time of calculation of the CAGR, profits are assumed to be reinvested over a particular time period. Within a particular time horizon, the profits are invested for making accurate calculations.

What Is The Compound Annual Growth Rate?

Compound Annual growth rate means the yearly rate of growth from an investment over a particular time period. It can be more than one year as well. It represents one of the effective ways to determine the value of the assets, investment portfolios, and any other things. The value of which can rise and fall over a specific period of time. You can cross-check your income statement with the help of this CAGR.

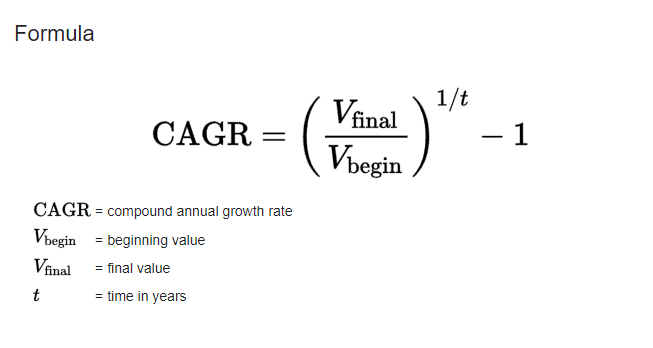

Compound Annual Growth Rate Formula

You must know the formula for making the calculation of the CAGR. The more accurate you will be in your approach, the easier things will become in the long run.

Check your cash flow statement to make the calculation of CAGR accurately. You should follow the formula to make an accurate calculation of your investment.

Benefits Of Calculating Compound Annual Growth Rate

There are several benefits to calculating the CAGR for your investment. You must know them beforehand before starting the calculation process accurately. If you want to track your return on your investment, then accurate calculation of the Compound Annual Growth Rate is essential.

1. Standardized Comparision

CAGR provides a standardized method for comparing the growth of investments or businesses with different time frames or starting points. It allows for a level playing field when assessing the performance of various assets or ventures. It offers a statement of comprehensive income.

2. Smoothen Out Volatility

Compound Annual Growth Rate smooths out the impact of short-term volatility. It focuses on the overall growth rate over a specified period, which is especially useful for investments prone to fluctuations. Similar kind of information you will receive in Investopedia.

3. Offers Long Term Perspective

It emphasizes long-term performance, which is often more relevant for investors and businesses than short-term fluctuations. The compound annual growth rate helps you understand the compound growth over the years. You can make the future forecast of your business growth and stability quite easily. One of the best tools for investors in making an informed decision making. You can gain similar information on the corporate finance institute website as well.

4. Useful Investment Analysis

CAGR is a valuable tool for analyzing the performance of investments, such as stocks, mutual funds, and real estate. It gives investors insights into how their investments have grown over time. If you want the complete information of any shares and stocks then CAGR can help you in it. Make the application of this formula for a better investment.

5. Benchmarking

Compound Annual Growth Rate is perfect for comparing the growth of an investment or business against a benchmark or industry average. This is particularly useful for assessing whether a particular investment or venture outperforms or underperforms its peers. You can compare the ceiling rate and can benchmark the stock prices with complete ease.

6. Goal Setting

CAGR helps individuals and businesses set realistic financial goals based on historical growth rates. It provides a basis for projecting future performance and setting achievable targets. Your process of investment will become easier with the help of this tool. Setting the business goals and achieving them will become a matter of gameplay for you if you make the application of this technique. Try out this method from your end.

7. Risk Assessment

When you analyze CAGR, you can gain a better understanding of the risk associated with an investment. A consistently high CAGR may suggest higher risk, while a more stable compound annual growth rate could indicate lower risk. You can get the probable date of the investments where the higher amount of risk is present. Making the correct investment decisions will become easier for you. Try out the best ways to reduce the chances of the risk to a great extent.

8. Strategic Decision Making

It can instill confidence in investors or stakeholders by demonstrating a track record of consistent growth. This can be applicable as a persuasive tool for attracting capital or partners. You can make efficient strategic decision-making with the help of CAGR. Try to develop methods that can offer you the chance to get the right assessment of the market data. It will help in better decision-making for your organization.

9. Investor Confidence

It enables you to evaluate how an investment or business has performed historically. Identifying trends and areas that may need improvement. It provides a basis for projecting future performance and setting achievable targets. Your investors will get the confidence to make investments in your company. You can encash these opportunities for your business growth in the future.

How To Use Clear Tax Compound Annual Growth Rate Calculator?

There are some simple steps you can follow to make the calculation of the CAGR tax calculation perfectly. Let’s find out the process one after the other.

- The initial value of the investment you need to fill first.

- Fill in the final value of an investment and the number of years of the investment in the second step.

- The CAGR calculator will reflect the Compound annual growth rate from your investments.

Final Take Away

Hence, if you want to make use of the CAGR method, then you need to follow the mentioned steps. You cannot make your calculations out of the dark. Once you complete the process of the calculation, you will get a clear picture of the market data to fulfill your business goals.

You can share your experience with us after making the application of this formula. Your feedback plays a vital role in crafting better content for you next time.

Continue Reading:

Leave A Reply