5 Essential Strategies For Effective Insurance Planning In Wealth Management

Today, it is hard to consider insurance planning and wealth management as two separate aspects. Insurance planning identifies the risks and creates a financial safety net around you, considering the current market scenario.

Another great thing about effective insurance planning is how it takes into your current financial condition and, at the same time, acknowledges that your financial situation can change over time. So, the assets you or your family get secured with insurance planning.

Do you want to know how insurance planning can be instrumental in wealth management? Let’s explore practical strategies for planning the insurance right.

What Is Insurance Planning And What Is Its Importance In Wealth Management?

Insurance planning is the process of identifying the potential risks and creating the right safety box (financial) with the best policies. So, if you have earned some wealth or there is a sudden financial windfall, make sure that you invest the money in policies that take care of your and your family’s financial needs in the future.

Insurance planning is safe for wealth management because of the detailed risk management associated with it. Through the process, insurance companies identify the risks and evaluate how the risks can impact your life.

Insurance planning prepares you for your financial requirements in the future. Thus, planning insurance has emerged as a powerful tool in managing your wealth.

Here are the benefits insurance planning can yield for your financial management.

- Financial security

- Diversification of your financial portfolio

- Insurance coverage against risks and uncertain occurrences

- Tax benefits

- Eliminating risks of losing all your savings

Based on your requirements, you can choose a wide range of insurance policies. You can choose life insurance, health insurance, motor insurance, and travel insurance policies that are up for grabs. Further, most people consider insurance policies effective for financial safety, and that is reflected in the market data.

“It is forecast that the global insurance market will grow by about one trillion U.S. dollars between 2023 and 2028, reaching almost 10 trillion U.S. dollars.” (Source)

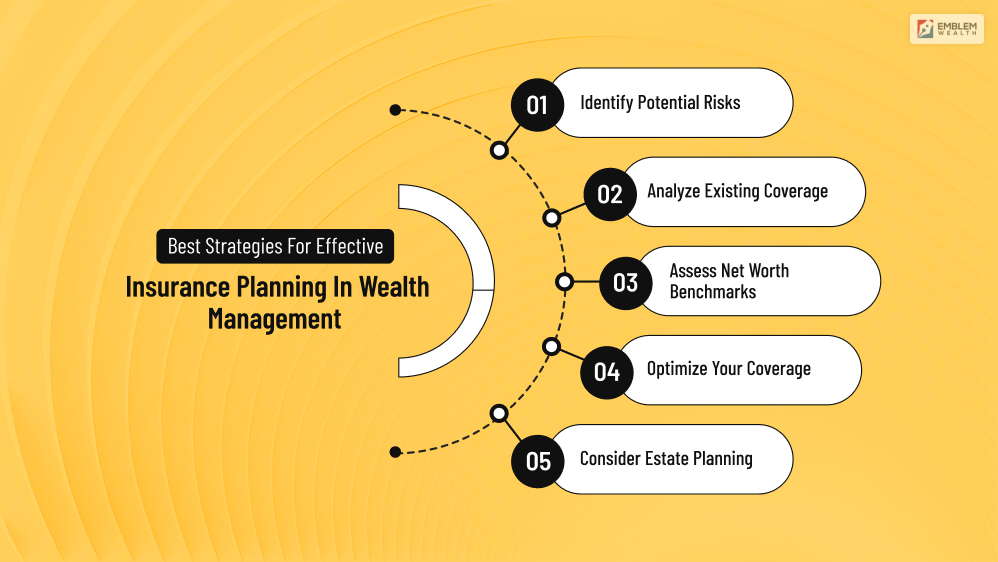

Best Strategies For Effective Insurance Planning In Wealth Management

If you want to optimize your financial security through the right wealth management, you have to consider your goals, responsibilities, and risk factors. Further, while choosing the right insurance policy that supports your financial portfolio, you have to assess your assets and liabilities.

These factors are crucial to determine how much investment you can make in insurance policies and the optimum coverage you can get from it. So, your policy should be personalized and cater to your specific financial requirements.

In this regard, Jacob Kujala, the wealth management insurance strategist for U.S. Bancorp Investments, an affiliate of the U.S. Bank, has the best words. He says,

“Your insurance policies are unique and very individualized to your situation. Your estate plan, your legacy, and your wishes after you’re gone must be taken into consideration.”

Want to know more? Here is a detailed overview of how you can strategize your investments in insurance policies.

1. Identify Potential Risks

One step in insurance planning is identifying potential risks. It could threaten your financial well-being. You must assess personal and professional risks. This includes health issues, disability, property damage, liability claims, and loss of income.

Personal risks primarily pertain to unforeseen events potentially causing emotional harm or loss. These could be health-related issues or even premature death. Health insurance and life insurance policies are the tools to combat these situations.

Professional risks refer to situations where health problems, disabilities, or other factors impact your ability to earn a living. Here, the other factors include the loss of jobs or business failures. In such circumstances, professional liability claims, professional indemnity insurance, and income protection can be your safety nets.

2. Analyze Existing Coverage

You can assess your insurance coverage once you have identified potential risks. This includes reviewing all current policies to determine gaps in coverage.

You may be initially happy with a policy that asks you to pay lower premiums. However, ensure that it does not have high deductibles. Otherwise, it can fall short of the financial protection you are looking for.

Knowing The Right Analysis Of Your Policy In Light Of Disability Insurance Costs

Disability insurance costs can vary depending on various factors. These include the individual’s age, occupation, health condition, and the level of coverage desired.

Younger individuals generally pay lower premiums compared to older ones, as they are considered to have a lower risk of disability. Occupations that involve higher levels of risk may result in higher premiums due to the increased likelihood of injury or illness.

Furthermore, pre-existing health conditions can also affect the cost of disability insurance. Lastly, the amount of coverage chosen will impact the price, as more comprehensive coverage will typically come with higher premiums.

3. Assess Net Worth Benchmarks

As part of estate planning, it is also essential to regularly assess your net worth. You should also set benchmarks for insurance coverage. Considering Net Worth Benchmarks can help ensure adequate protection. This is based on your current assets, liabilities, and income.

A number of dependents and future financial goals should also be considered. It is recommended that these benchmarks be reassessed and adjusted at least once a year.

4. Optimize Your Coverage

You may need to adjust based on your risk assessment. This could include increasing coverage limits and adding new policies to fill gaps. Some are switching to more comprehensive policies with better terms.

When optimizing your coverage, balancing adequate protection and cost-effectiveness is essential. While having higher coverage limits may provide better protection, it can also result in higher premiums. Working with an experienced insurance advisor can help you find the right balance.

5. Consider Estate Planning

Estate planning is another essential aspect of insurance planning in wealth management. It involves creating a plan to distribute your assets after you pass away.

Life insurance can be an effective tool for estate planning. It can provide a tax-free lump sum payment to beneficiaries upon the policyholder’s death. This can help cover any outstanding debts, taxes, and funeral expenses. It offers financial support for loved ones.

Reviewing and updating your estate plan and insurance policies regularly is crucial. It helps to reflect any changes in your life circumstances or financial goals.

Knowing Effective Insurance Planning in Wealth Management

Effective insurance planning in wealth management involves identifying potential risks.

Further, insurance planning is an essential component of a well-rounded wealth management strategy as it is not a “one-and-done transaction.” You must optimize the benefits of insurance planning by taking into account factors like your present income, investments you have already made, concerns, and your financial goals.

What is your take on the role of insurance planning in wealth management? Have you already invested in insurance policies? Don’t forget to share your thoughts with us!

Continue Reading:

Leave A Reply