Analyzing The Statement Of Comprehensive Income: Key Metrics To Look Out For

The value of a company and its growth can be measured by its statement of comprehensive income. This statement is a broader financial metric that states the net income of a company, along with other forms of comprehensive income as well.

Therefore, if you wish to evaluate the financial standing of your business, then you must learn the uses of this comprehensive income statement. To learn more about it, read this post till the end.

In this post, you will learn the key metrics that you must look out for on this statement. In addition, you will also learn about its benefits and drawbacks.

What Is Comprehensive Income?

Before you can understand what the statement of comprehensive income is, I must first explain what comprehensive income is.

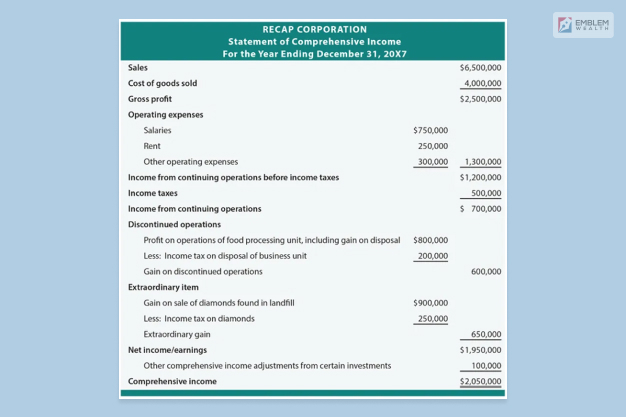

The comprehensive income of a company is a financial statement that states its net income and other comprehensive income (OCI). This statement is crucial for a company since it measures its financial standing. Therefore, shareholders can use this statement to measure all equity changes the company has experienced over a certain period.

Since it showcases equity changes over a certain period, stakeholders can use it to analyze the performance of the company by comparing it with others. Comparing two income statements like this will provide a clearer picture as to which company is faring better. This helps shareholders to measure their investment’s financial outlook.

Every public company reports its comprehensive income in its final balance sheet calculated at the end of every fiscal year. You can spot this under the section called Stakeholder’s Equity. On the other hand, private companies and non-profit organizations show their comprehensive income as a part of their net assets.

Comprehensive income typically comprises all sales revenue, unrealized profits & losses, hedges of cash flow, investment portfolio performance, and debt securities.

You can divide your comprehensive income into two groups, namely:

1. Operating Comprehensive Income

Comprehensive income that is directly related to the operations of the business is referred to as operating comprehensive income. Some examples of this are:

- Interest

- Dividends

- Profits and losses pertaining to transactions of foreign currency

2. Investment Comprehensive Income

Comprehensive income that is not related to the operations of the business is referred to as comprehensive investment income. One example of this is unrealized profits and losses from sellable securities.

What Is The Statement Of Comprehensive Income?

Now that you know what an organization’s comprehensive income is, it’s time for you to learn what the statement of comprehensive income is.

As you might already know, the income statement of an organization states lots of information regarding its revenues and expenses. In addition to including interest and taxes, it also shows an organization’s Net Income – which is stated at the bottom.

However, an income statement will only show the earned revenues and incurred expenses of the firm.

In order to take into account other comprehensive income in the form of unrealized profits and losses which do not appear as a part of the income statement, a comprehensive income statement is required. This gives investors a better picture of the company’s financial standings, helping them decide whether their investments are worth it.

Key Metrics Of The Statement Of Comprehensive Income

The two main metrics of the statement of comprehensive income that you must always keep an eye out for are:

1. Net Income

The net income of a company refers to the overall revenues earned and expenses made by a company. The revenues and expenses calculated here take place in the accounting year. In addition, various deductions like various costs, taxes, and allowances are made here.

The net income of your company can be negative, which means your company has made more expenses than the revenue earned.

To calculate this, you must use the net income formula, which is:

| Operating Revenue – Operating Expenses – Interests Expenses – Preferred Stock Dividends |

2. Other Comprehensive Income (OCI)

The main metric of the statement of comprehensive income refers to all the revenues, expenses, profits, and losses of your firm that have not been realized yet in your books of accounts. Since its unrecorded, it doesn’t appear in the income statement of the firm or its net income.

An example of OCI is the investments of a company that has not matured yet. Since your company hasn’t yet redeemed the final value gained or lost from such investments, it remains unrecorded in your income statement.

Some other examples of other comprehensive income are:

- Unrealized profits and losses on securities that your company is selling.

- Profits and losses from cash flow hedges.

- Adjustments made in foreign currency translation and foreign currency investment hedges.

- Profits and losses due to post-retirement plans and pensions.

- Unrealized profits and losses from debt securities that get transferred.

Statement Of Comprehensive Income: Benefits & Drawbacks

The statement of comprehensive income confers several benefits and drawbacks to your company.

Pros

The main advantages your company will benefit from are:

- This statement portrays a better “comprehensive” view of the income of your firm.

- You will be able to make better operational decisions depending on the additional information presented in this statement.

- Investors can use this statement to judge the financial position of your company before investing.

Cons

The main drawbacks your company will suffer from are:

Since various unrealized income is clearly stated here, it might paint a different picture of the actual financial standing of your company as per accounting and financial guidelines.

The unrealized values are simply assumed and are not actual earnings.

It doesn’t show the true future profitability of the firm since it draws assumptions based on previous metrics.

Bottom Line

As explained above, the statement of comprehensive income refers to a more expansive income statement of a company. It shows in detail the various different additional and unrealized revenues and expenses of the firm that do not get calculated in the official net income statement of the firm.

If you have any doubts, comment down below, and I will clear it out as soon as possible!

Explore More:

Leave A Reply