How To Analyze A Cash Flow Statement To Make Informed Business Decisions?

Financial managers and leaders mainly use three types of fundamental financial statements – cash flow statements, balance sheets, and income statements. In this article, we will talk mainly about the usage and utility of cash flow statements. Hence, to understand the details of how to analyze cash flow statements read on through to the end of the article.

Cash flow statements are extremely important for financial management. This is because they provide extremely important financial data, which helps in informing the decision-making of an organization. Although the rest of the statements are also important for getting an idea of the finances, most business leaders will stand for cash flow statements only.

What Is A Cash Flow Statement?

According to the official website of Harvard Business School,

“Business owners, managers, and company stakeholders use cash flow statements to better understand their companies’ value and overall health and guide financial decision-making.”

Hence, you can understand the importance of cash flow statements in getting an idea of the finances of a particular business.

But what actually is a cash flow statement? – It is nothing but a financial report, where you will get information on how cash came into the business and how it went out within a particular timeframe. It basically gives the business owners and managers a detailed picture of what happened to the cash of the business during a particular accounting period. The accounting period, in most cases, is of one year.

The Utility Of Cash Flow Statements

Cash flow statements give a detailed picture of the different areas within a business where cash is received or where cash is spent within a particular time period. This insight into cash flow helps in getting an understanding of how the business operates and how the managers should consider doing the valuation of the company.

According to Emeritus.org,

“a cash flow statement summarizes a company’s cash receipts as well as payments throughout a specific accounting period. It also offers an overview of how the company’s operating, investing, and financing actions impacted its cash position.”

Hope you understand the utility and importance of a cash flow statement for a business.

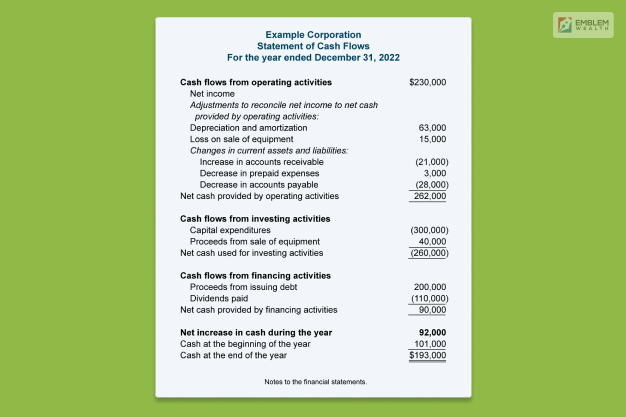

Cash Flow Statement Example (Format)

In terms of cash flow statement format, it is quite simple. It mainly consists of three sections –

1. Cash flow from Operating Activities.

2. Cash flow from investing Activities.

3. Cash flow from Financing Activities.

By calculating all the values within the three activities, finance experts determine the cash and cash equivalents at the end of the year.

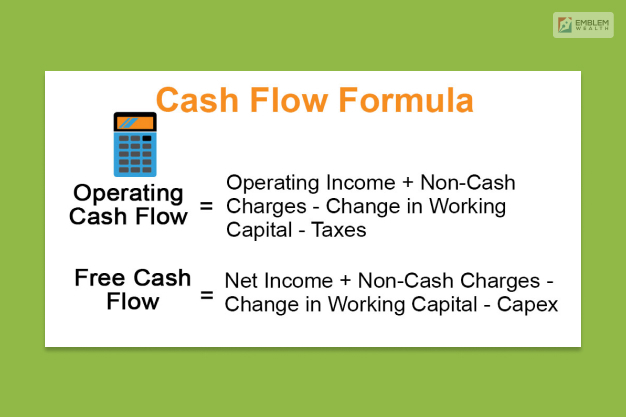

How To Calculate Cash Flow?

Cash flow calculation is simple but not easy. You need to go through mainly five steps to create a full-fledged cash flow statement. There are mainly fives steps you need to follow to calculate a cash flow statement:

1. Finding Out The Starting Balance

It is obvious that the starting balance is the most important feature that one must include inside a cash flow statement. The first step is to include the starting balance at the beginning of reporting period. You can find this value from the same period’s income statement, which is another essential financial statement.

This is really important if you are using the indirect method to calculate cash flow from the operating activities of your business. However, in the direct method, this information is not necessary.

2. Calculating Operating Activities Cash Flow

Once you have found out the starting balance, you need to find the operating activities cash flow. This step is necessary to find out the amount of cash that the company generated from its operations processes. You can calculate the operations activities cash flow using the direct method or the indirect method.

No matter which method you use, you will get the same number in both cases. The only thing you need to know regarding the direct methods and indirect methods is that the former is simple but time-consuming, while the latter is complicated but faster.

3. Calculating Investing Activities Cash Flow

In the cash flow calculation process, the investing activities come in the second number after you have calculated cash flow from operating activities. The investment can be the assets of the companies that are considered to be fruitful for the future.

According to the official website of Harvard Business School,

“This section of the cash flow statement details cash flows related to the buying and selling of long-term assets like property, facilities, and equipment. Keep in mind that this section only includes investing activities involving free cash, not debt.”

4. Calculating Financing Activities Cash Flow

Here, you will need to calculate the cash flow processes that are related to the financing activities of the company. In this case, you will need to consider both the cash flows from equity financing and debt financing. These are nothing but those cash flows that are associated with raising cash for the business and the cash flow associated with paying back business debts to creditors and investors.

Here, you will also need to include other details like-

a. The paid dividends

b. Interests paid.

You can include both these cash flow factors also in the section containing cash flow from operating activities.

5. Finding Out The Ending Balance

Once you have accounted for the cash flows that your business activities have generated, you will be able to determine two things – The ending cash balance, and the cash equivalents, during the close of the reporting period of that year.

The difference between the net cash from the cash flow from the business activities gives you the value. This is the cash that the business gained or lost during the period of accounting. The positive value shows that the business had more cash flowing into it, while the negative value shows that cash went out of business.

Summing Up

Hope you have got an idea of the importance of a cash flow statement for business during every financial year. Do you think the cash flow statement is more important than income statements and balance sheets? Share your opinion in the comments section below.

Explore More:

Leave A Reply