Improving Online Payments Using Fraud Screening Technology

Ensuring an easy and convenient checkout for your customers is one of the best ways to improve conversions in your online store.

The challenge for businesses is distinguishing between genuine customers and fraudsters.

Fraudsters are becoming smarter and are using increasingly sophisticated methods of defrauding businesses.

A Changing Environment

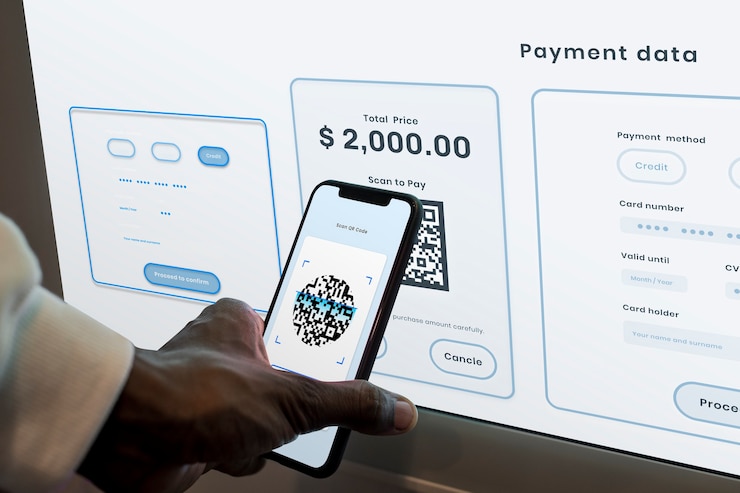

We know that in the past few years, customer payment behaviors have changed. We now pay for goods and services using our credit or debit cards, mobile payment options, and by scanning QR codes.

E-commerce has become a major part of our lives. Consumers are taking help from E-commerce sites to get everything from clothes to groceries. If you are an online business that accept ecommerce online payments, you need to make sure that you have proper security in place. You might be storing some confidential financial information that you don’t want to get into the wrong hands.

Additionally, many of us now have several email addresses, social media accounts, and phone numbers that we use on different devices. All of this introduces complexity that individuals and businesses must deal with when making or receiving a payment.

These options also introduce complexity for businesses trying to differentiate real users from fraudsters.

Customers Want a Seamless Buying Journey

Customers making purchases on an online store want a frictionless payment journey. Introducing any complexity into this process causes frustration that leads to customers leaving. When they leave, they buy from another merchant or business, and this translates into a loss of sales and reduced revenue for the business.

Customers who have such experiences can also talk about them online or with their friends, which spreads a bad reputation and reduces the likelihood of someone buying from your business.

When you use the wrong fraud detection system, you risk introducing complexity and friction that leads to customers leaving without completing a purchase.

Merchants Want Higher Conversion Rates

Merchants, on the other hand, are tasked with finding the delicate balance between ensuring a great experience for their customers while also eliminating fraud. They want their customers to be who they say they are without risking losing them.

In other words, they want to ensure a great customer experience and high conversion rates while also reducing fraud.

The question becomes, how can businesses find the right balance?

Screening Online Payments

Fortunately, businesses have access to tools that help them have a high certainty that a customer is not a fraud while also ensuring their payment journey is tailored to ensure the best customer experience.

Advanced fraud detection and screening use identity technology to validate not only users but also their details and payment information. These technologies give businesses a snapshot of the customer’s identity when they place an order while allowing the business to flag any potentially fraudulent transactions.

When accepting online payments, especially ACH payments, businesses must ensure that they use solutions that adhere to the latest Nacha account validation rules.

The account verification solution provided by Yodlee, for example, meets the new Nacha account validation rules while also ensuring a seamless and pleasant experience for your customers.

Yodlee develops fintech apps and services for individuals, banks, wealth managers, merchants, and anyone who wants to have better control over their money and wealth. All their apps and services adhere to the strictest privacy and security standards.

| Note: Businesses must find a balance between ensuring a great customer payment experience and preventing fraud. This way, they can give customers the experience they expect while also ensuring high conversion rates due to little friction during the payment process. |

Additionals:

- 8 Ways to Improve Your Ecommerce Website

- 5 BENEFITS OF TAKING PERSONAL INSTALLMENT LOANS IN TEXAS

- Getting Cash Now From Your Long-Term Structured Settlement Annuity

Leave A Reply