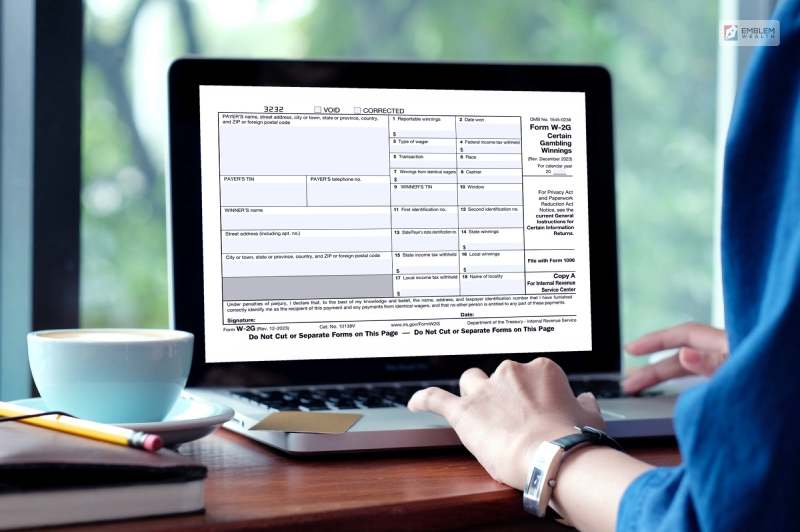

Understanding Your Form W-2G: A Step-by-Step Breakdown

Form W-2G is a document for internal revenue for all the casinos and other documents that other establishments send. It sends the customers comprised of the other winnings during the prior year.

The Income Revenue System seeks to watch the tax report of the gambling winners using the tool Form W-2G. The form contains the information of the taxpayer who needs to file the taxes for the year.

It comprises the total winnings on the date or the dates they won. How much state and federal income tax is being withheld from the form? You need to get through the complete process with ease.

What Is Form W-2G?

The Form W-2G is known for being an Internal Revenue Service or IRS document. In general, a casino or other gambling company sends to their winning customers during a particular time period. The document mentions the amount that a customer needs to report as their income on their tax return.

The Form W-2G, which is also known as Certain Gambling Winnings, includes the total sum of winning, the dates when it was won, the wager type, and the amount that the federal as well as state income tax has withheld.

It is crucial to know that whatever you win at a gamble is taxable. However, there are only a few that are recorded with this specific Form W-2G.

Gambling Winnings Thresholds: Form W-2G

You can report the gambling winnings on the Form W-2G if:

- The winning amount is around $1200 or more and won from a bingo game or slot machine.

- Someone won $1500 or more from a Keno Game.

- Someone won around $5000 or more from any poker tournament.

- The winning amount is nearly around:

- $600 or more.

- 300 times more the amount of the wager

- If the amount is subjected to federal income tax withholdings.

Who Can File The Form W-2G?

Certain people have to fill out Form W-2G. You should report all the winnings during the process of your gambling activity. It includes several things, such as Bingo, lotteries, racing, sports, slots, and machines.

- $1200 and more in winnings from all kinds of Bingo as well as slot machines.

- $1500 or more if you win from the Keno competition.

- $5000 or more if you win from poker tournaments.

- $600 or winnings from any other types of tournaments.

If you participate in the games of skills, then you do not have to fill out Form W-2G. You need to be aware of it in this regard. Follow the correct process that can make things easier for you in attaining your requirements with ease. You can view the website of Investopedia to have a better idea of it.

Filing And Submitting Form W-2G

There are some of the simple steps that you need to follow in order to fill out the W-2G form. You cannot make your own decisions, and the choices are on the wrong end. You should follow some of the simple steps that can make things easier for you in attaining your goals.

Obtain A Copy Of Form W-2G

Firstly, you should receive a Form W-2G from the payer if your gambling winnings meet certain thresholds. The payer is typically a casino, racetrack, or other gambling establishment. Make sure you have the correct version of the form for the tax year in question.

Provide Your Information In Form W-2G

The next step is to fill out your information. On the top of the form, you will need to provide your personal information, including your name, address, and Social Security Number (SSN) or taxpayer identification number. With proper and accurate application of the strategies, things can turn out better for you.

Describe The Winnings

Thirdly, in Part I of the form, you will describe the gambling winnings you received, including the type of gambling activity, the date of the winnings, the name and address of the gambling establishment, and the total winnings. This information is typically provided to you by the payer.

Withholding Information

After describing the winnings, if any federal income tax was withheld from your winnings, it will be reported in Box 4. This tax withholding is usually at a rate of 24%. If you had state income tax withheld, it may be reported in Box 15. Form W-2G helps individuals avoid such penalties by providing a precise mechanism for reporting these winnings.

Sign & Date The Form

Before you submit the form, you need to sign and date the form to certify that the information you provided is accurate. Ensure that you should sign & date the form that can make things easier for you to reach your needs with proper ease. Develop a better solution that can assist you in getting things done in perfect order.

Submit The Form

Lastly, you typically don’t need to send the form to the IRS with your tax return. Instead, you should keep a copy for your records. However, if you believe that the tax withheld exceeds your actual tax liability, you may want to file a federal income tax return to claim a refund.

Benefits Of W-2G Form

There are several benefits of the W-2G Form that you must take care of if you want to get the maximum results for your business. Some of the key benefits of the W-2G forms are as follows:-

Reporting Income

Form W-2G is used to report gambling winnings to the IRS, ensuring that these winnings are included in your taxable income. This helps maintain the integrity of the tax system by preventing underreporting of income. At the time of Tax audit, it can be of great help.

Withholding Tax

The form also reports any federal income tax that was withheld from your gambling winnings. This withholding helps to ensure that the IRS receives tax revenue from your winnings immediately. It simplifies the process for individuals who may not have the discipline to set aside money for taxes on their gambling income.

Compliance

Receiving a Form W-2G reminds recipients of their tax obligations. It promotes compliance with tax laws by making individuals aware of their responsibility to report and pay taxes on their gambling winnings. At the time of progressive tax, things can become easier for you.

Record Keeping

Form W-2G serves as an essential record for individuals to keep for their financial records. It helps individuals maintain a clear record of their gambling activities, including the amount of winnings, where they won, and any taxes withheld. These records can be valuable when preparing tax returns and for potential IRS inquiries. Keep the rate of return in proper parity.

For your own documentation purposes, it is crucial to keep all the documents, for instance, wager statements as well as payment slips, ready every time you are gambling. These documents can help you verify the overall accuracy of all the information related to the form or the W-2G that you received.

Audit Trail

The form provides the IRS with an audit trail, making it easier for them to identify and verify taxable gambling winnings. This transparency helps ensure that individuals accurately report their income, reducing the likelihood of tax evasion.

Uniform Reporting

The use of Form W-2G creates a standardized method for reporting gambling winnings across various gambling establishments, such as casinos, racetracks, and lotteries. This consistency simplifies the tax reporting process for both individuals and the IRS.

Final Take Away

Hence, if you want to get the maximum returns Form W-2G, then you have to get through the process with complete ease. Ensure that the scope of the errors is as low as possible from your counterpart.

You can share your views and comments in our comment box it can assist us in knowing your take on this matter. Develop a better plan that can make things easier and perfect for your tax audit under the process of form W-2G.

Continue Reading:

Leave A Reply