What Is The Difference Between Direct And Indirect Costs With Examples In 2021

The identification, measurement, and allocation of expenditures can aid in determining the organization’s actual profit. The costs are divided into direct and indirect costs depending on the degree of traceability to products. There are direct costs and indirect costs associated with running a business. It’s crucial to keep track of these expenses in order to keep your records up to date, receive tax deductions, and make business decisions.

The two costs differ in that one can identify and assign expenditure to a specific cost object or cost center. You can set the price both competitively and precisely when you know the exact expenses of manufacturing and delivering your products or services to customers. As a result, knowing the difference between direct and indirect expenses is important when pricing your products or services.

What Are Direct Costs?

Direct costs are expenses that can be directly linked to a single “cost item,” such as a product, department, or project, by a corporation. Software, equipment, and raw ingredients are all examples of this. It can also involve labor, provided that the labor is unique to the product, department, or project.

Direct costs might be constant or variable. Variable costs are expenses that fluctuate depending on the number of goods you create or the number of services you provide. The direct costs are divided into three portions based on factors, which are collectively known as the prime cost:

- Direct Material: It denotes material costs that can be allocated to production. For example, raw materials that are used in the unit’s production.

- Direct Labor: Wages paid to laborers who are identifiable by a cost object. Bonuses, gratuities, provident funds, perquisites, and incentives, for example, are all included in the phrase wages.

- Direct Expenses: It comprises all other costs directly related to the manufacturing of a product. For example, job processing fees, tool, and equipment rental fees, and subcontracting fees.

What Are Indirect Costs?

When it comes to the matter of direct and indirect, learning indirect cost is necessary. Indirect costs include those associated with sustaining and running a business in addition to those associated with creating a product. These are the costs that remain after direct costs have been calculated. Indirect costs include the materials and resources required for a company’s day-to-day operations. These elements contribute to the overall success of the organization, although they are not assigned to the provision of any specific service.

Utilities, supplies, rental, office equipment, desktop computers, and cell phones are examples of indirect costs. Indirect costs, like direct expenses, can be constant or variable. Rent is an example of a fixed indirect expense. The fluctuating costs of energy and gas are examples of variable costs. You may also allocate indirect costs to see how much money you’re spending on expenses against sales.

What Is The Difference Between Direct And Indirect Costs?

1. For Taxes

When it comes to tax deductions, it’s important to understand the distinction between direct and indirect costs. However, you must separate your company expenses from the expenses you use to estimate your cost of products sold, such as direct labor expenditures, according to the IRS. To calculate your gross profit on your business tax return, deduct your cost of goods sold from your gross revenue.

You can’t deduct an item that’s included in your cost of goods sold as a business expense. Rent and employee compensation are just a few of the business expenses that might be deducted. However, in order to do so, you’ll need accurate and precise documents to back up your claims. When claiming deductions, it’s possible that you’ll be audited by the IRS if you misclassify your direct and indirect expenses. Furthermore, failing to break down your charges may result in you missing out on a tax deduction.

2. For Income Statements

Knowing which costs are direct and which are indirect might assist you in, reporting expenditure in your records and on your income statement. Your income statements detail the profits and losses of your company over time.

You have different line items for income and expenditure on your income statements, such as revenue, cost of products sold, and operating expenses. On the income statement, an indirect cost would not be recorded under the cost of goods sold. Indirect expenditures should be listed under company expenses instead.

3. For Pricing Products

All expenses must be considered when running a business. Budgeting requires you to do so. You can also check your cost of goods sold to see how much it costs to manufacture a product. The cost of goods sold, on the other hand, only gives you direct costs, not indirect ones.

An activity-based costing (ABC) method can help you figure out how much it really costs to make a product or provide a service. You can allocate your overhead costs to specific activities, and hence products, using the ABC approach to gain a more detailed picture of your expenditures by product.

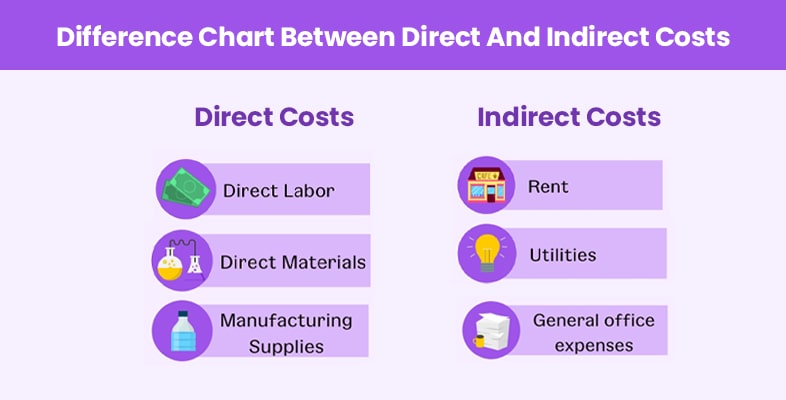

Difference Chart Between Direct And Indirect Costs

|

Basis For Comparison |

Direct Cost |

Indirect Cost |

| Meaning | These are the expenses that can be simply identified as per the cost objects. | These are the costs that aren’t easy to be identified as per the cost objects. |

| Expended On | Particular Cost Objects | Multiple Cost Objects |

| Identified As | It can also be regarded as variable costs. | It can also be known as fixed costs. |

| Position In Cost Sheet | It’s calculated at the start of the cost sheet. | It is determined after the direct costs have been calculated. |

| Aggregate In Cost Sheet | An aggregate of direct costs in the cost sheet is termed prime cost. | The aggregate of indirect costs in the cost sheet is called overhead cost. |

| Example | An example of this cost is the cost attributable to direct material, direct labor, and direct wages. | Example of this cost is rent, advertisement, etc. |

How Direct And Indirect Costs Accounted When Applying In Acquisition Method?

| Points | Direct Cost | Indirect Cost |

| A | Expensed | Expensed |

| B | Increased investment account | Decreased investment account |

| C | Increased investment account | Decreased |

| D | Increased investment account | Increased investment account |

| E | Expensed | Decreased investment account |

Final Thoughts

It’s critical to know the difference between direct and indirect costs. Because if you don’t know how to properly allocate and attribute your costs, you won’t be able to calculate the profit per unit after selling your products or services. Costs are fixed or variable for both direct and indirect costs. To be able to use this information in the required part, you must use it.

Read Also:

Leave A Reply